The dental industry might be in the beginnings of the “new normal”. Many key signals used to evaluate the state of the dental industry are showing similar data over time, which poses the question, “Are we seeing a normalization of the dental industry, at least in the short-term?”

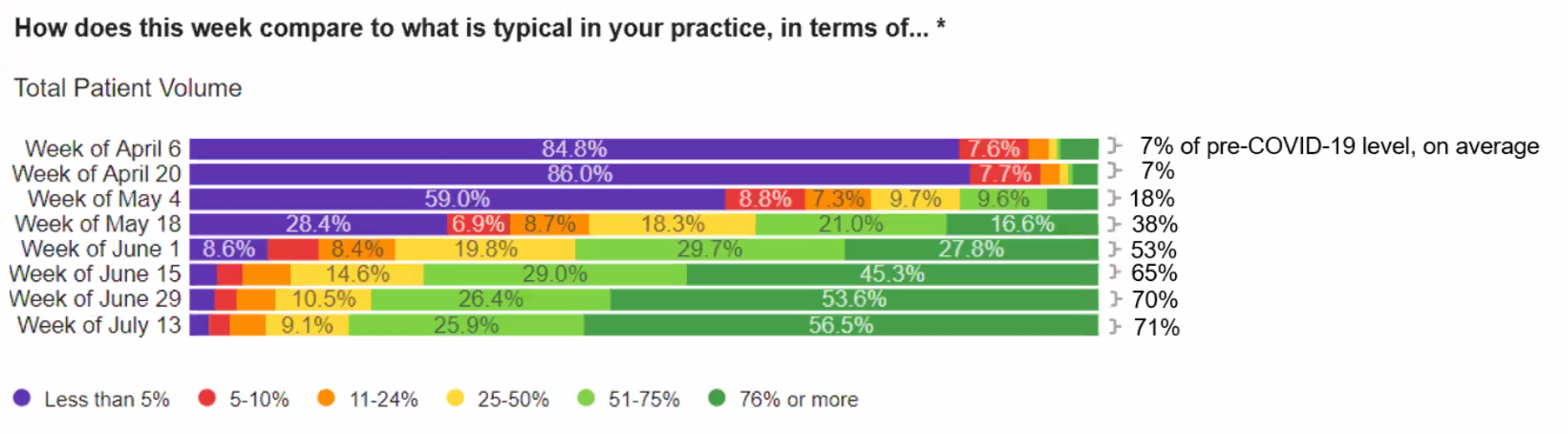

A few of the key indicators, including the amount of practices open, patient volumes and staffing levels, all show similar data compared to previous surveys in that practices are open, patients are seeking treatments and staff levels are appropriate to support the patient volume. As of the week of July 13th, 98% of dental practices in the U.S. were open for business. This number did not change from the two weeks prior. In addition, patient volumes nationwide were consistent with the two weeks prior at about 70% of pre-COVID-19 levels. This volume of patients could very well be where the dental industry stays in the short-term. Finally staffing in dental practices is approximately 90% of pre-COVID-19 staffing levels. Again, the same as reported in the two weeks prior. It remains to be seen if this stabilization continues.

These national trends are very well aligned with the data from the 27 states that opened the earliest. In the weeks after the 27 states opened, HPI started segmenting them separately to help understand emerging trends. As more and more states have opened for business, the national trends have caught up with these states and they may not be the best indicator for emerging trends going forward.

However, there is a new segment of data that HPI hypothesized may show new trends. They are high population states with a recent significant increase in COVID-19 cases including Texas, California and Florida. In reviewing the data from these three states, as of the week of July 13th, they did not find a decrease in patient volumes, even with significant increases in the number of infections. Perhaps that will change in future survey data, but as of right now, patients are still feeling comfortable going to the dentist.

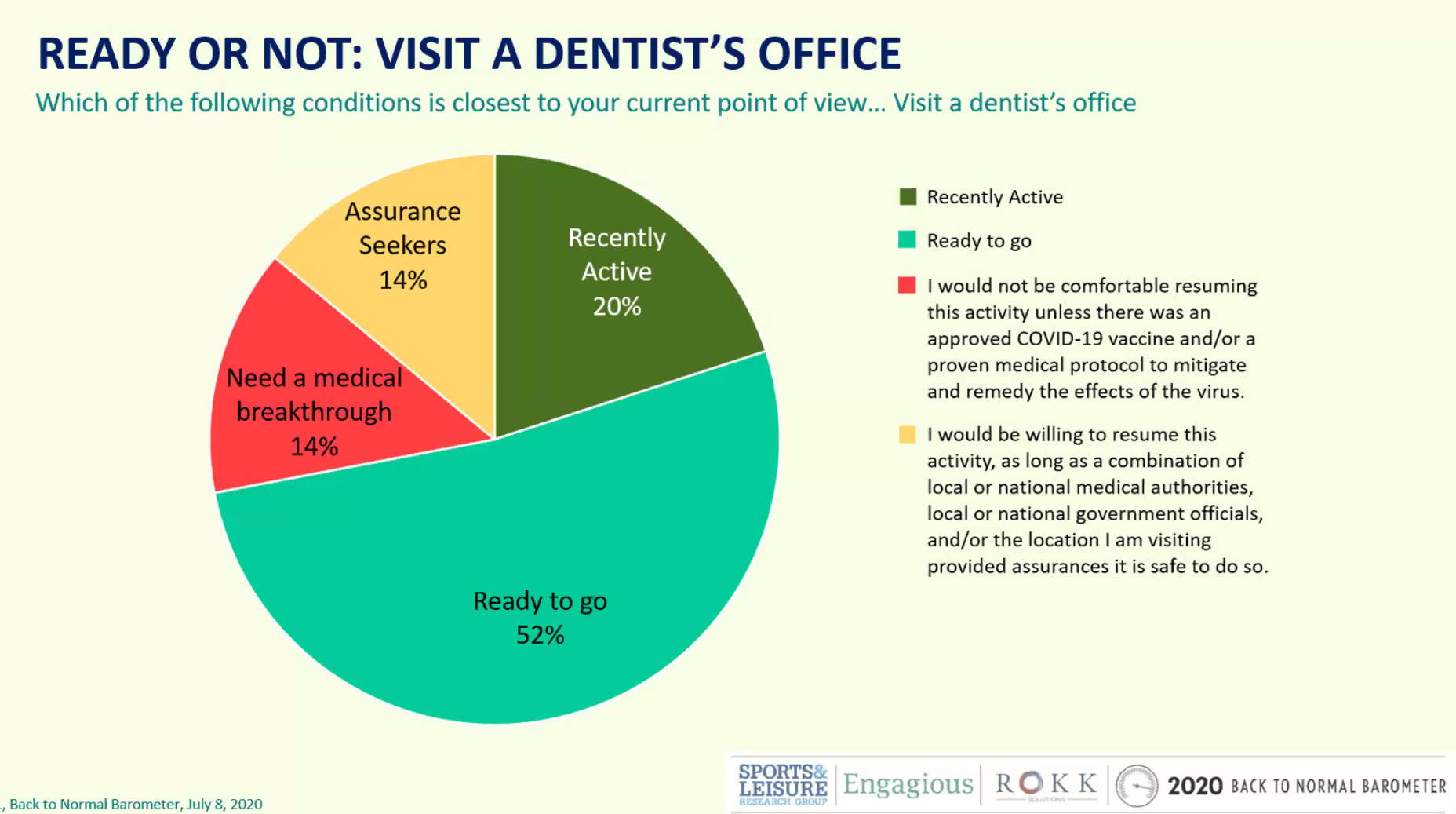

This positive patient sentiment toward dental care is reflected in data obtained by Engagious, a company HPI partnered with to better understand the consumer perspective on dental care. In fact, the survey found that when asked “Which of the following conditions is closest to your current point of view in visiting a dentist’s office”, 20% stated they already visited a dental office and 52% are “ready to go”. That shows that almost 75% of dental patients are not deterred in getting their dental care. Another 14% need assurance from national or local government or medial authorities to consider going to the dentist and another 14% will not go to the dentist until a vaccine is available.

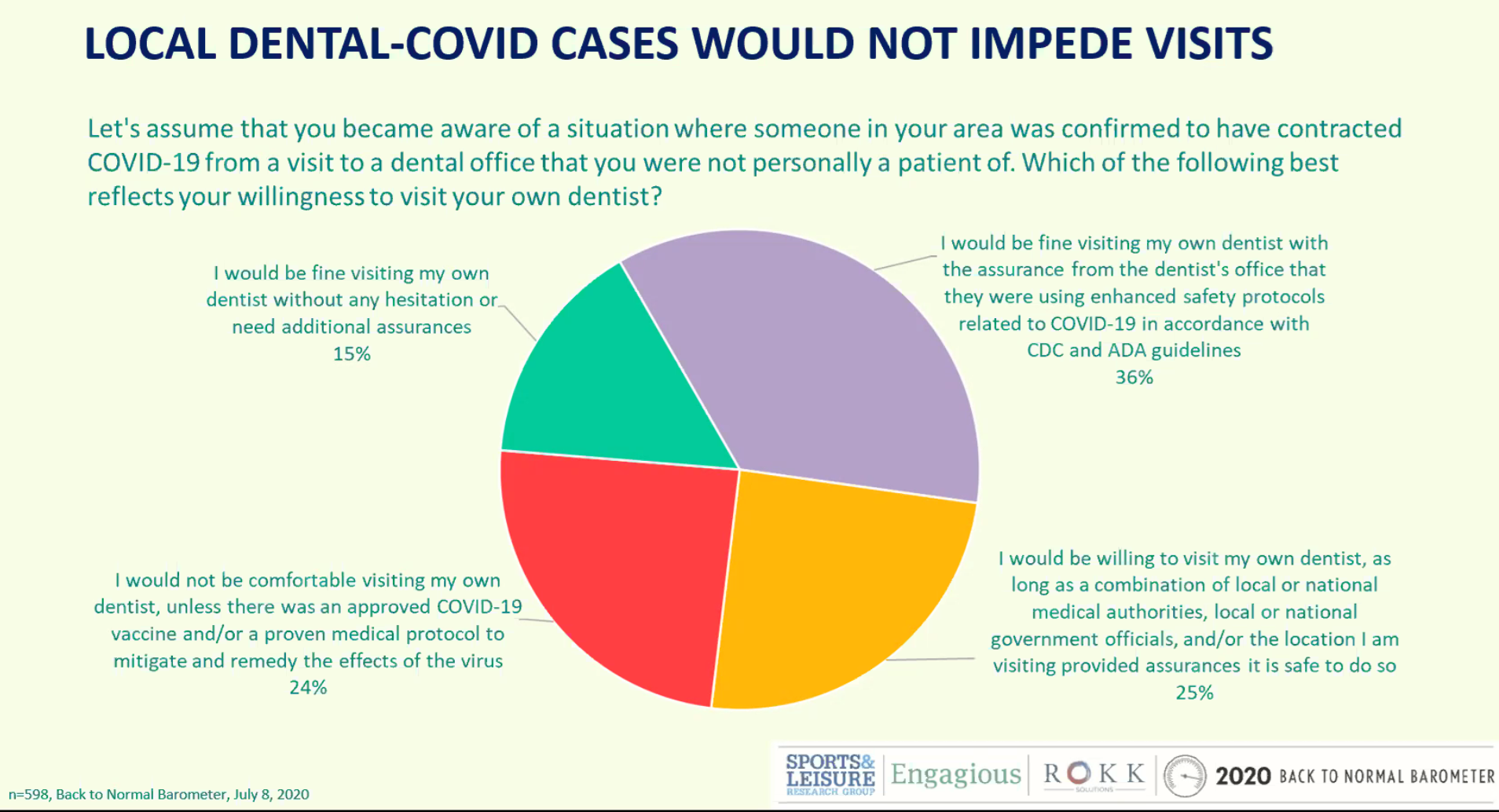

To better understand patient sentiment toward dental care in environments with increasing cases of infection they then asked patients to assume that a person at dental office in their area was confirmed to have contracted COVID-19 from a dental practice. How likely were they to still seek dental care? Still, 50% would be willing to visit their dentist either with reassurance from their dental practice that they were following safety protocols or without any assurance at all. Another 25% would need a combination of assurance from their dentist as well as assurance from medical or government agencies. Finally, 24% would not go to the dentist until a vaccine is available in this scenario.

Even though the dental industry is not recovered to 100% of pre-COVID-19 levels, there is much to be positive about. With 98% of dental offices open, patient volume around 70% of pre-COVID-19 levels, staffing at 90% of pre-COVID-19 levels and patient sentiment being very positive around the dental industry, the dental industry recovery seems to be going well. As of now, it looks like we might have met the “new normal” in this dynamic environment.