In a new round of data collected by the Health Policy Institute (HPI), key metrics tracking the recovery of the dental industry continues to increase, although at a slowing slower pace than in previous weeks. From patient volume to rehiring to new patient capacity data, this could be the beginning of the plateauing of the dental industry’s comeback.

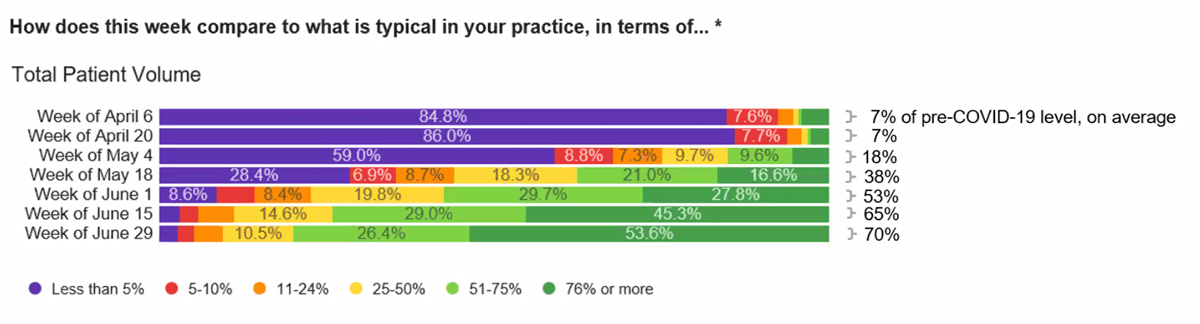

As of the week of June 29th, 97% of dental offices were open in the United States. Patient volumes reached 70% of pre-COVID-19 levels. Although this was an increase from 65% the week of June 15, the increase of 5% was less than increases in prior weeks.

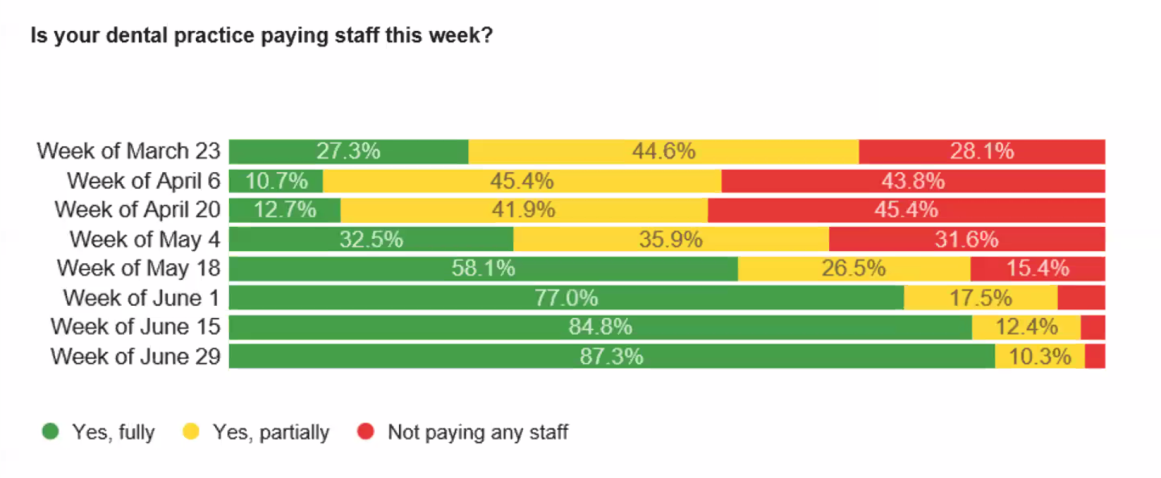

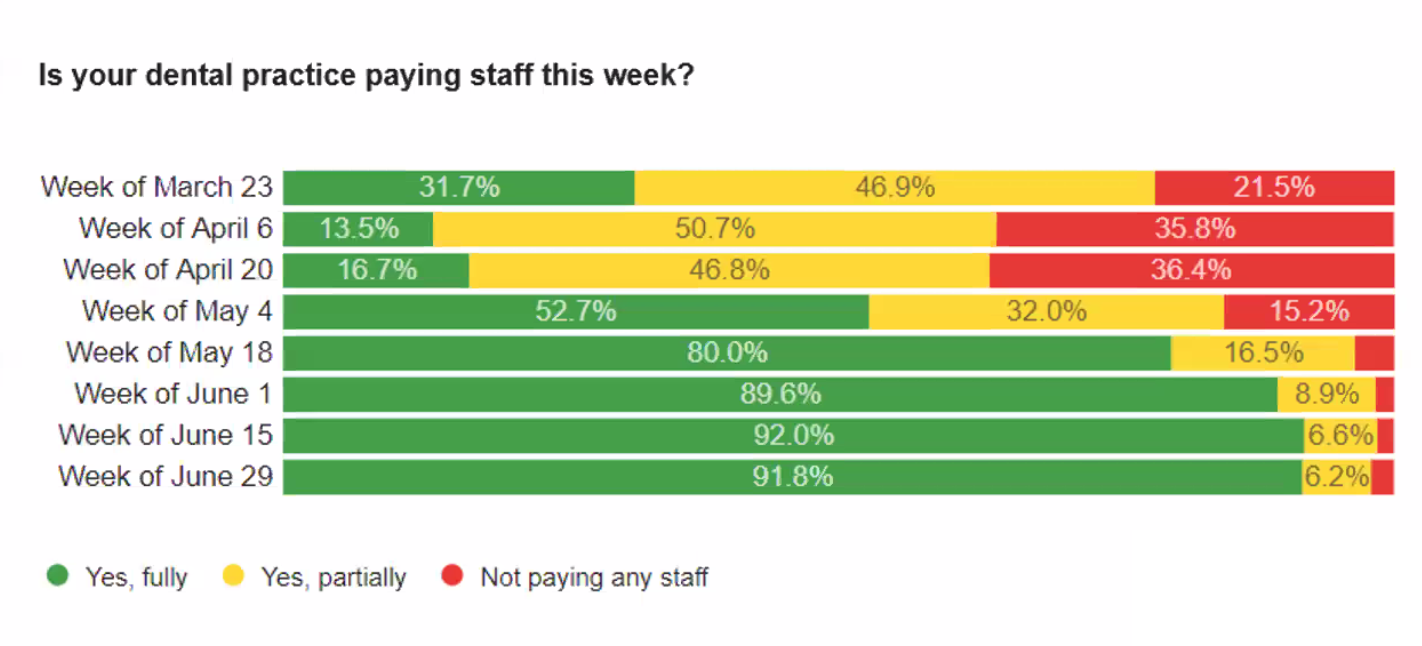

As patient volumes increase, so does the hiring back of staff. As of the week of July 29th, 87% of staff was hired back fulltime with 10% working part-time. In reviewing the change of staffing levels in recent weeks, we find the changes in full-time and part-time work have not changed much. We might be seeing a plateauing of staff being hired back; suggesting these staffing levels might be the “new normal”. Of those that have not been hired back, or are only partially back, a majority appear to be employee dentists. Nearly two-thirds of employee dentists have been hired back fully, but a third are not back to work fulltime. Of all staff, employee dentists seem to be the ones hit hardest.

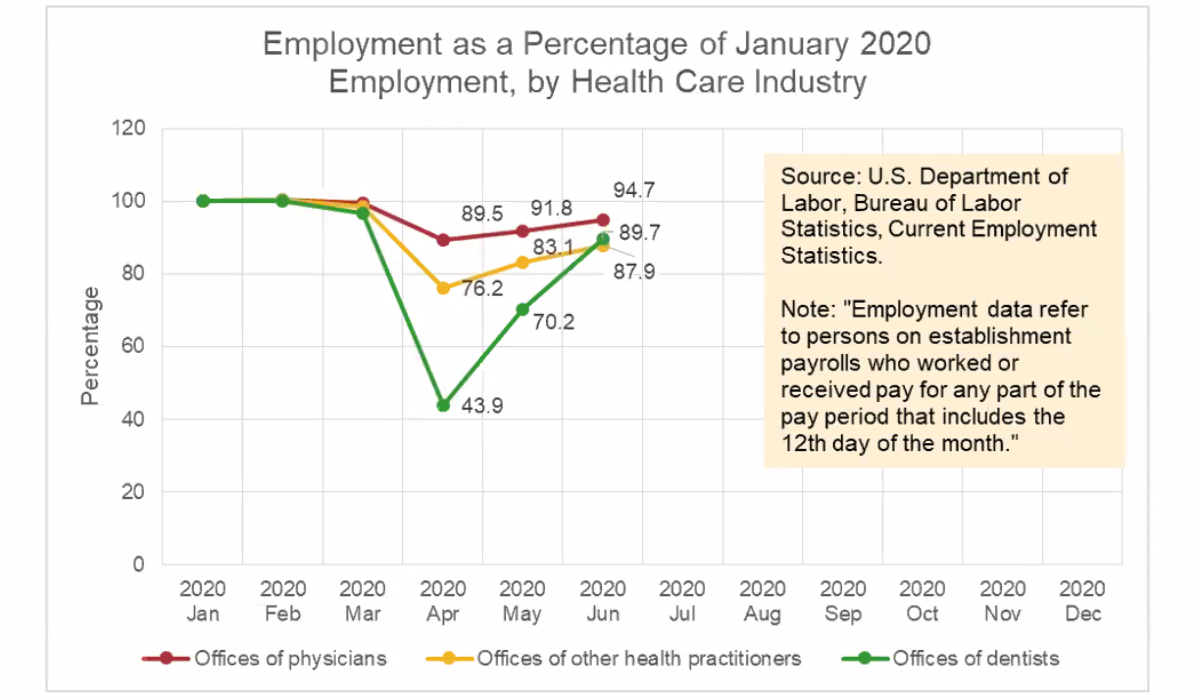

In reviewing the hiring back of dental staff, the HPI also looked at the Bureau of Labor Statistics data through June 2020. It showed that the dental industry continued to hire back from May to June making the “V” shaped trend line most were hoping for as seen above. The Bureau of Labor Statistics data shows that 90% of the dental industry is back to work. This data aligns well with HPI’s survey data.

With the dental industry largely getting back to work, HPI added some questions to better assess patient capacity. They asked how the number of hours per week that practices are open has changed prior to COVID-19. A majority, 68%, stated practice hours are the same as pre-COVID-19. There were 16% that said their practice was open less hours and 16% that said their practice was open more hours. With hours mainly staying at pre-COVID-19 levels, they asked questions to understand the change in the maximum number of patients practices could see in a day. The average maximum number of patients was 32 prior to COVID-19, although it changed drastically to 24 patients when asked what the maximum number of patients they could actually see today. When asked how many patients they actually are seeing in a day, practices reported about 21 patients. This indicates patient volumes are close to the new maximum levels.

With all of this said, we can see the dental industry continues to grow. To get an early lead of where the dental industry is going, they look at a subset of 27 states that have been open for the last seven consecutive weeks. Those states were the ones first to open back up and maybe a good indicator of new trends. In those states, the rebound is starting to slow down. In these states, 97% of dental offices are open and 47% are back to “business as usual”.

In looking at the patient volumes of those 27 states, they now have patient volumes at 72% of pre-COVID-19 levels. The increase from the two weeks prior was only 2%.

The same story of slow growth can be seen in the hiring back of staff within these 27 states. As of the week of June 29th almost 92% of staff is back to work fulltime, actually slightly down from two weeks prior. Perhaps we are seeing the “new normal” in staffing levels, with employment only being 90-95% of pre-COVID-19 levels.

There is much to be positive about in regard to the trend of the dental industry, although we should be aware that the rate we are recovering may be slowing. The dental economy continues to rebound with 97% of dental offices in the U.S. open and patient volume at 70% of pre-COVID-19 levels. Hiring has rebounded to about 90% of pre-COVID-19 levels. However, COVID-19 has had an impact on maximum patient capacity. It remains to be seen if this change in capacity actually becomes an issue. Some dentists were “not busy enough” prior to COVID-19. We will continue to watch how the industry changes in the coming weeks.