Consumer attitudes towards visiting the dentist and the long-term impacts of COVID-19 are issues that greatly affect dental practices. It is important to stay aware of these trends in order to maintain success during such an uncertain time. Looking at recent numbers, it seems as though the status of dental practices are working their way towards the “new normal”. But will this normalization continue in the dental industry or could the pandemic hinder this process?

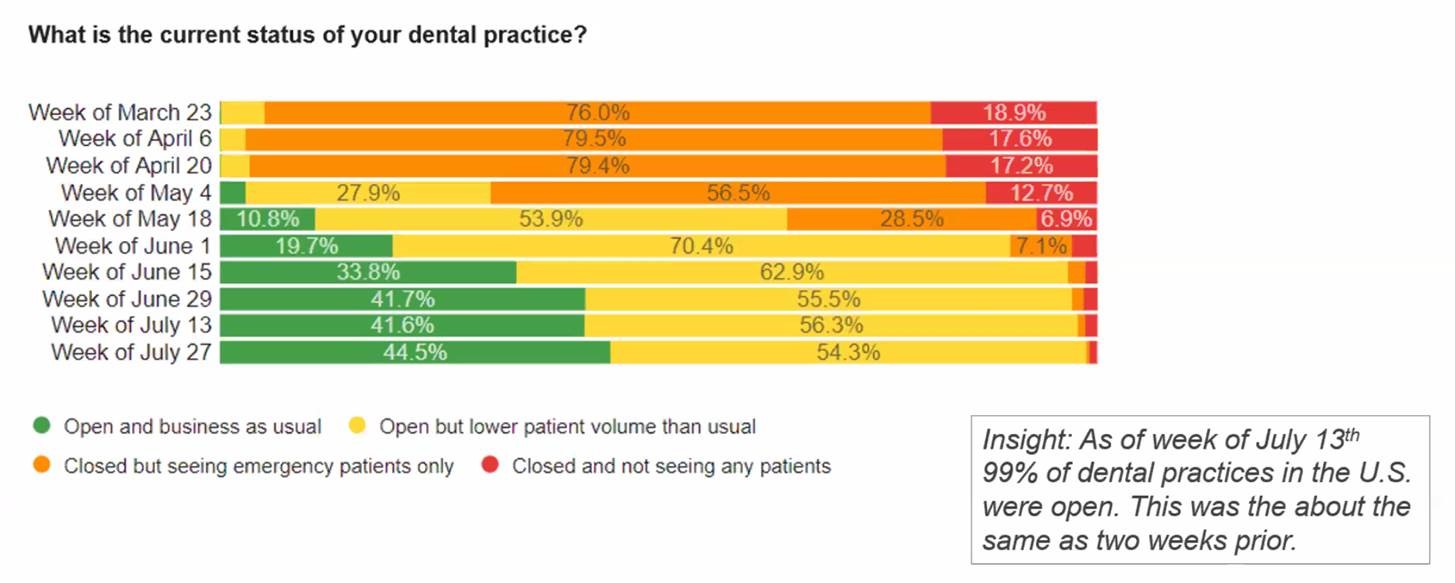

During initial closings, most dental practices agreed that they closed while only seeing emergency patients. But recently the numbers of open offices have increased in terms of being fully open or being open with a lower patient volume than usual. As of the week of July 27th, 44.5% are open as usual while 54.3% are experiencing less patient volume. While comparing this to the trends in March, the change is tremendous.

There are multiple key factors that can play into the status of a dental practice. Some of which being public opinion, local COVID-19 cases, dentist to patient communication, public affairs, and obtaining PPE. Luckily for dental offices, these categories are showing positive trends that help to stimulate the industry.

The current public opinion reflects the idea that people are considering the dental industry to be “essential healthcare” among things such as retail stores and essential services done in the house. 23% of people have had recent activity at the dentist, 57% are ready to go back, 8% are assurance seekers, and 12% need a medical breakthrough to consider returning. Not even local COVID-19 cases would impede patient visits according to surveys, with only about 24% of people saying they would not be comfortable going to a dentist without a vaccine or appropriate protocol. The numerous government programs that aim to help dentists also help relieve the pressure of maintaining a successful business.

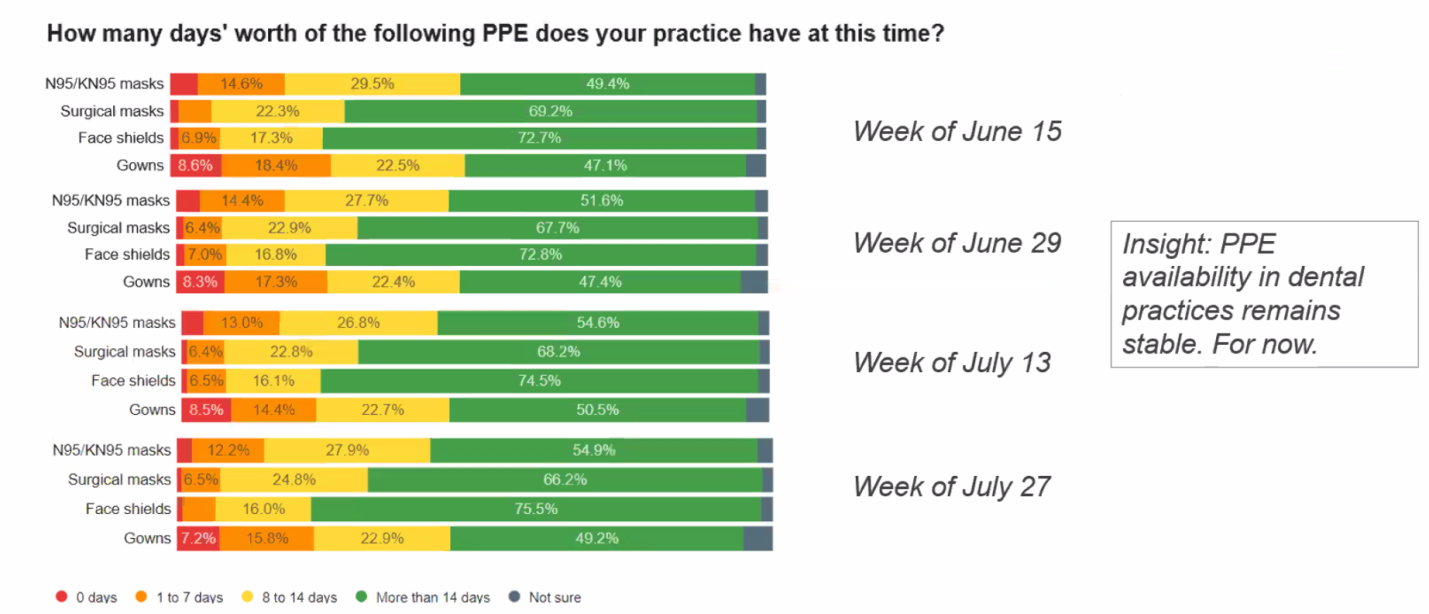

When considering the issue of obtaining PPE, the numbers are stable in recent weeks. Across the board, the numbers are fairly repetitive for all of the products. For the more than 14 days’ worth category the numbers lie between about 45% up to about 75%. 8 to 14 days also shows a lot of consistency while ranging from 15% to 30%. As companies began to rebuild their stock and work hand-in-hand with dental offices the issue of a lack of PPE is shrinking. Hopefully, this continues to be the case as the uncertainty over the future of the pandemic grows.

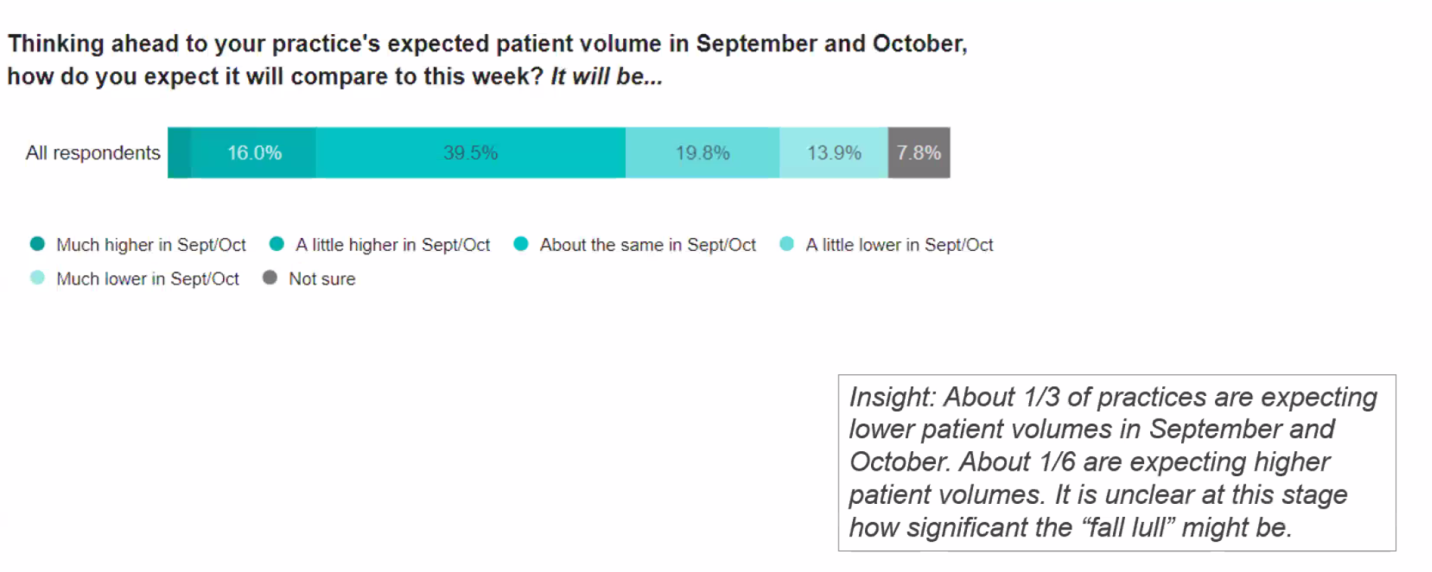

Regardless of the success of the current climate of the dental industry, many are worried about the significance that a “fall lull” will have on practices. Only about 1/3 of practices are expecting lower patient volumes in the months of September and October while 1/6 are expecting higher patient volumes. To be more exact, 39.5% are expecting the numbers to be slightly higher, 19.8% expects numbers to stay about the same, and 13.9% are predicting patient volume to be slightly lower. It is unclear what the case will be due to the inability to predict the future of the dental industry and how the pandemic will be handled.

Although there are many positive aspects to the current trends of the dental industry, it is also important to be aware and consider the possibility of a “fall lull”. There are many steps that can be taken in preparation towards this possibility to ensure the best outcome for your dental office. For now, it is very assuring that patients have a positive outlook on the dental industry and consider it to be a part of their essential healthcare.